U.S. - Cement - Market Analysis, Forecast, Size, Trends And Insights

Get instant access to more than 2 million reports, dashboards, and datasets on the IndexBox Platform.

View PricingUS Builders Slammed With Hefty Price Hike on Cement – Fueling Higher Materials Cost

Cement is a key ingredient in concrete, and thus is an important factor in the cost of construction projects. According to IndexBox data, US cement import price soared to $85 per ton in Apr 2022.This represents a 14 percent increase, and builders are understandably concerned about how this will impact their bottom line.

The Reasons Behind the Price Hike

The price hike is being blamed on a number of factors, including an increase in fuel costs and a shortage of clinker (a key ingredient in cement). The price increase is already starting to have an impact on builders. According to Ken Simonson, chief economist for the Associated General Contractors of America, the higher cost of cement is "one more straw that could break the camel's back."

If the price hike goes through as expected, it could have a major impact on construction projects across the country. So far, there's no word on how builders will respond, but it's safe to say that they're not going to be happy about it.

U.S. Cement Import Price in 2021 - 4M2022

The average cement import price stood at $85 per ton in Apr 2022, picking up by 14% against the previous month. Over the last fifteen months, it increased at an average monthly rate of +29.3%. As a result, import price reached the peak level and is likely to continue growth in the immediate term.

There were significant differences in the average prices amongst the major supplying countries. In Apr 2022, the country with the highest price was Canada ($104 per ton), while the price for Thailand ($49 per ton) was amongst the lowest.

From Jan 2021 to Apr 2022, the most notable rate of growth in terms of prices was attained by Turkey (+60.0%), while the prices for the other major suppliers experienced more modest paces of growth.

Cement Imports into the U.S.

In Apr 2022, cement imports into the United States fell modestly to 1.9M tons, remaining relatively unchanged against Apr 2021. The total import volume increased at an average monthly rate of +29.3% from Jan 2021 to Apr 2022; however, the trend pattern indicated some noticeable fluctuations being recorded throughout the analyzed period. The pace of growth was the most pronounced in Mar 2022 when imports increased by 30% m-o-m. Imports peaked at 2.1M tons in Jul 2021; however, from Aug 2021 to Apr 2022, imports failed to regain momentum.

In value terms, cement imports expanded markedly to $161M (IndexBox estimates) in Apr 2022. Over the period under review, total imports indicated a significant expansion from Jan 2021 to Apr 2022: its value increased at an average monthly rate of +29.3% over the last fifteen - month period. The trend pattern, however, indicated some noticeable fluctuations being recorded throughout the analyzed period. Based on Apr 2022 figures, imports increased by +58.5% against Dec 2021 indices. The pace of growth appeared the most rapid in Apr 2021 when imports increased by 37% month-to-month. Over the period under review, imports attained the peak figure in Apr 2022 and are expected to retain growth in months to come.

The Lagest Importers on the U.S. Cement Market

Turkey (710K tons), Canada (366K tons) and Mexico (258K tons) were the main suppliers of cement imports to the United States, with a combined 70% share of total imports. These countries were followed by Greece, Vietnam, Colombia, Taiwan (Chinese), Egypt and Thailand, which together accounted for a further 24%.

From Jan 2021 to Apr 2022, the biggest increases were in Egypt (with a CAGR of +101.4%), while purchases for the other leaders experienced more modest paces of growth.

In value terms, the largest cement suppliers to the United States were Turkey ($52M), Canada ($38M) and Mexico ($21M), with a combined 69% share of total imports.

Turkey, with a CAGR of +162.9%, recorded the highest growth rate of the value of imports, among the main suppliers over the period under review, while purchases for the other leaders experienced more modest paces of growth.

How the Price Hike Will Impact Construction Projects

The recent price hike on cement has US builders extremely concerned. The cost of this crucial construction material has risen sharply, and there is no end in sight. This increase will inevitably lead to higher construction costs, which will put a strain on budgets and make it more difficult to complete projects on time and on budget.

The good news is that there are ways to offset the impact of the price hike. One option is to use alternative materials that can provide the same structural strength as cement but at a lower cost. Another option is to negotiate with suppliers to try and get a better price.

Whatever strategy you choose, it's important to stay calm and think long-term. The price hike may be a setback, but it doesn't have to derail your entire construction project.

Alternatives to Traditional Cement

While the price of traditional cement has been on the rise in recent months, there are a number of alternative materials that builders can turn to in order to keep costs down. One popular option is fly ash, which is a byproduct of coal combustion that can be used in place of traditional cement. Fly ash is not only more affordable than traditional cement, but it is also more environmentally friendly.

Another alternative material that is gaining popularity among builders is recycled glass. Recycled glass can be used in a number of different ways, including as an aggregate in concrete or as a replacement for sand in mortar. Not only is recycled glass more affordable than traditional materials, but it can also help to reduce the carbon footprint of a construction project.

Finally, builders may also want to consider using natural fibers instead of traditional cement. Materials such as bamboo and hemp have been shown to be strong and durable, making them ideal for use in construction projects. Natural fibers are also more environmentally friendly than traditional materials, making them a great choice for builders who are looking to green their operations.

Conclusion

In light of the recent news that cement prices have risen sharply in the US, builders are scrambling to find ways to offset the higher costs. Many are looking for alternatives to traditional construction materials, such as concrete, in order to keep their projects on budget. Others are trying to negotiate better deals with suppliers. Whatever the case may be, it is clear that the rising cost of cement is having a ripple effect on the construction industry, and builders will need to be creative in order to keep their projects on track.

This report provides an in-depth analysis of the cement market in the U.S.. Within it, you will discover the latest data on market trends and opportunities by country, consumption, production and price developments, as well as the global trade (imports and exports). The forecast exhibits the market prospects through 2030.

Product coverage:

- Prodcom 23511210 - Portland cement

- Prodcom 23511290 - Other hydraulic cements

Country coverage:

- United States

Data coverage:

- Market volume and value

- Per Capita consumption

- Forecast of the market dynamics in the medium term

- Trade (exports and imports) in the U.S.

- Export and import prices

- Market trends, drivers and restraints

- Key market players and their profiles

Reasons to buy this report:

- Take advantage of the latest data

- Find deeper insights into current market developments

- Discover vital success factors affecting the market

This report is designed for manufacturers, distributors, importers, and wholesalers, as well as for investors, consultants and advisors.

In this report, you can find information that helps you to make informed decisions on the following issues:

- How to diversify your business and benefit from new market opportunities

- How to load your idle production capacity

- How to boost your sales on overseas markets

- How to increase your profit margins

- How to make your supply chain more sustainable

- How to reduce your production and supply chain costs

- How to outsource production to other countries

- How to prepare your business for global expansion

While doing this research, we combine the accumulated expertise of our analysts and the capabilities of artificial intelligence. The AI-based platform, developed by our data scientists, constitutes the key working tool for business analysts, empowering them to discover deep insights and ideas from the marketing data.

-

1. INTRODUCTION

Making Data-Driven Decisions to Grow Your Business

- REPORT DESCRIPTION

- RESEARCH METHODOLOGY AND AI PLATFORM

- DATA-DRIVEN DECISIONS FOR YOUR BUSINESS

- GLOSSARY AND SPECIFIC TERMS

-

2. EXECUTIVE SUMMARY

A Quick Overview of Market Performance

- KEY FINDINGS

- MARKET TRENDS This Chapter is Available Only for the Professional Edition PRO

-

3. MARKET OVERVIEW

Understanding the Current State of The Market and Its Prospects

- MARKET SIZE

- MARKET STRUCTURE

- TRADE BALANCE

- PER CAPITA CONSUMPTION

- MARKET FORECAST TO 2030

-

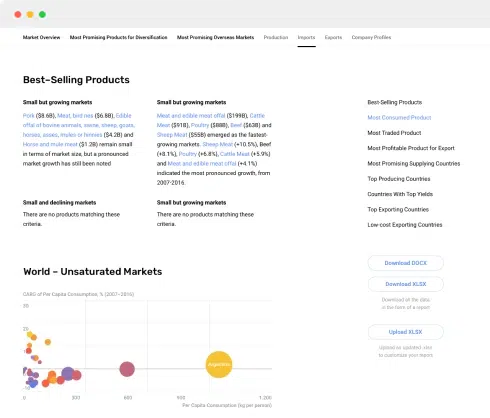

4. MOST PROMISING PRODUCT

Finding New Products to Diversify Your Business

This Chapter is Available Only for the Professional Edition PRO- TOP PRODUCTS TO DIVERSIFY YOUR BUSINESS

- BEST-SELLING PRODUCTS

- MOST CONSUMED PRODUCT

- MOST TRADED PRODUCT

- MOST PROFITABLE PRODUCT FOR EXPORT

-

5. MOST PROMISING SUPPLYING COUNTRIES

Choosing the Best Countries to Establish Your Sustainable Supply Chain

This Chapter is Available Only for the Professional Edition PRO- TOP COUNTRIES TO SOURCE YOUR PRODUCT

- TOP PRODUCING COUNTRIES

- TOP EXPORTING COUNTRIES

- LOW-COST EXPORTING COUNTRIES

-

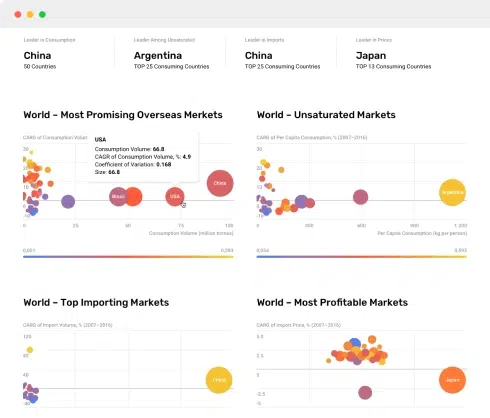

6. MOST PROMISING OVERSEAS MARKETS

Choosing the Best Countries to Boost Your Exports

This Chapter is Available Only for the Professional Edition PRO- TOP OVERSEAS MARKETS FOR EXPORTING YOUR PRODUCT

- TOP CONSUMING MARKETS

- UNSATURATED MARKETS

- TOP IMPORTING MARKETS

- MOST PROFITABLE MARKETS

7. PRODUCTION

The Latest Trends and Insights into The Industry

- PRODUCTION VOLUME AND VALUE

8. IMPORTS

The Largest Import Supplying Countries

- IMPORTS FROM 2012–2023

- IMPORTS BY COUNTRY

- IMPORT PRICES BY COUNTRY

9. EXPORTS

The Largest Destinations for Exports

- EXPORTS FROM 2012–2023

- EXPORTS BY COUNTRY

- EXPORT PRICES BY COUNTRY

-

10. PROFILES OF MAJOR PRODUCERS

The Largest Producers on The Market and Their Profiles

This Chapter is Available Only for the Professional Edition PRO -

LIST OF TABLES

- Key Findings In 2023

- Market Volume, In Physical Terms, 2012–2023

- Market Value, 2012–2023

- Per Capita Consumption In 2012-2023

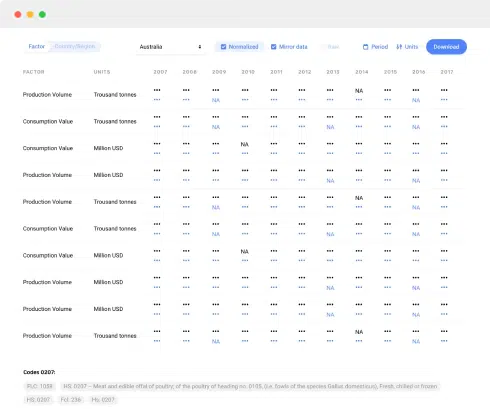

- Imports, In Physical Terms, By Country, 2012–2023

- Imports, In Value Terms, By Country, 2012–2023

- Import Prices, By Country Of Origin, 2012–2023

- Exports, In Physical Terms, By Country, 2012–2023

- Exports, In Value Terms, By Country, 2012–2023

- Export Prices, By Country Of Destination, 2012–2023

-

LIST OF FIGURES

- Market Volume, In Physical Terms, 2012–2023

- Market Value, 2012–2023

- Market Structure – Domestic Supply vs. Imports, In Physical Terms, 2012-2023

- Market Structure – Domestic Supply vs. Imports, In Value Terms, 2012-2023

- Trade Balance, In Physical Terms, 2012-2023

- Trade Balance, In Value Terms, 2012-2023

- Per Capita Consumption, 2012-2023

- Market Volume Forecast to 2030

- Market Value Forecast to 2030

- Products: Market Size And Growth, By Type

- Products: Average Per Capita Consumption, By Type

- Products: Exports And Growth, By Type

- Products: Export Prices And Growth, By Type

- Production Volume And Growth

- Exports And Growth

- Export Prices And Growth

- Market Size And Growth

- Per Capita Consumption

- Imports And Growth

- Import Prices

- Production, In Physical Terms, 2012–2023

- Production, In Value Terms, 2012–2023

- Imports, In Physical Terms, 2012–2023

- Imports, In Value Terms, 2012–2023

- Imports, In Physical Terms, By Country, 2023

- Imports, In Physical Terms, By Country, 2012–2023

- Imports, In Value Terms, By Country, 2012–2023

- Import Prices, By Country Of Origin, 2012–2023

- Exports, In Physical Terms, 2012–2023

- Exports, In Value Terms, 2012–2023

- Exports, In Physical Terms, By Country, 2023

- Exports, In Physical Terms, By Country, 2012–2023

- Exports, In Value Terms, By Country, 2012–2023

- Export Prices, By Country Of Destination, 2012–2023