China - Coal - Market Analysis, Forecast, Size, Trends and Insights

Get instant access to more than 2 million reports, dashboards, and datasets on the IndexBox Platform.

View PricingCoal Market in China: Analysis and Projections

As the world's largest consumer and producer of coal, China plays a pivotal role in global coal dynamics. According to recent data from IndexBox, China's consumption volume for coal in 2022 stood at a staggering 4.165 billion tons. This immense figure reflects China's extensive use of coal in various sectors, particularly in energy production, where coal-fired power plants are prevalent. China also utilizes coal in industrial processes, including steel and cement manufacturing, as well as for residential heating in some regions.

One of the key drivers of market growth in China is the country's industrialization and urbanization, which has led to increased energy demand. Despite global shifts toward renewable energy sources, coal remains a significant contributor to China's energy mix due to its relative affordability and the existence of established coal infrastructure. Additionally, the development of clean coal technologies in China is another factor sustaining coal consumption, as it aims to mitigate environmental concerns associated with coal use.

However, potential threats to the coal market in China include stringent environmental policies, international pressure to reduce carbon emissions, and a gradual shift towards renewable energy resources. The adoption of green technologies and the government's commitment to the Paris Agreement signal potential declines in the reliance on coal in the long term.

Main Coal Suppliers to China

IndexBox's market report shows that in 2022, China imported 320.508 million tons of coal, valued at $42.617 billion, with an average import price of $0.133 per kilogram. The structure of these imports has evolved, reflecting geopolitical events, market demands, and diversified sourcing strategies.

The top five coal suppliers to China in terms of import value in 2022 were Indonesia ($18.894 billion), Russia ($12.162 billion), Mongolia ($5.05 billion), Canada ($3.183 billion), and the United States ($1.807 billion). The prominence of Indonesia and Russia as China's main suppliers is indicative of geographic proximity, competitive pricing, and resource availability. However, recent political developments, such as sanctions on Russia, could potentially alter these dynamics, pushing China to seek alternative suppliers or to ramp up domestic production.

The changes in the structure of imports also reflect China's strategic efforts to ensure energy security. By diversifying its import sources, China is not only minimizing geopolitical risks but also stabilizing supply in the face of global market fluctuations.

Market Outlook

Looking ahead, the market outlook for coal in China is shaped by the balance between economic growth, energy needs, and environmental commitments. While short-to-medium-term forecasts may still see robust coal consumption, the long-term trajectory is expected to be influenced by renewable energy expansions and sustainability targets. The government's Five-Year Plans and other policy measures aimed at reducing pollution and carbon emissions are critical factors to monitor.

Moreover, technological advancements and efficiency improvements in coal usage could prolong its presence in the energy mix, although not indefinitely. The transition towards a greener economy might dampen demand for coal over time, necessitating market players to adapt and potentially diversify their business models to include more sustainable energy sources.

Largest Companies in the Coal Market

China's coal market is dominated by several large state-owned enterprises that have historically been the bedrock of the country's coal industry. These include China Shenhua Energy Company, China Coal Energy Company, and Yanzhou Coal Mining Company, among others. These giants operate extensive mining operations, possess advanced coal processing facilities, and have well-established distribution networks integrating rail, road, and port logistics.

As the coal industry evolves, these companies will likely face pressures to innovate and possibly consolidate to maintain profitability under stricter environmental regulations and changing demand patterns. The market dynamics may also welcome new entrants focused on clean coal technologies or mixed-energy solutions, further complicating the competitive landscape. Vigilance and flexibility will be key for companies seeking to thrive in the shifting terrain of China's coal market.

In conclusion, while China's coal market is currently robust, driven by industrial demand and energy production, its future is laden with uncertainties stemming from a global push towards sustainability. The coal industry in China is thus at a critical juncture, where adaptation and reinvention are not just opportunities but necessities for survival and growth in an increasingly eco-conscious world.

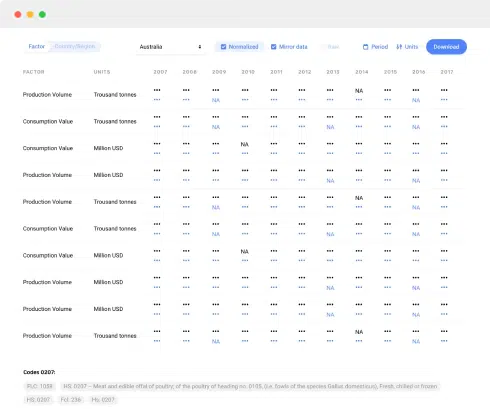

This report provides an in-depth analysis of the coal market in China. Within it, you will discover the latest data on market trends and opportunities by country, consumption, production and price developments, as well as the global trade (imports and exports). The forecast exhibits the market prospects through 2030.

Product coverage:

Country coverage:

Data coverage:

- Market volume and value

- Per Capita consumption

- Forecast of the market dynamics in the medium term

- Trade (exports and imports) in China

- Export and import prices

- Market trends, drivers and restraints

- Key market players and their profiles

Reasons to buy this report:

- Take advantage of the latest data

- Find deeper insights into current market developments

- Discover vital success factors affecting the market

This report is designed for manufacturers, distributors, importers, and wholesalers, as well as for investors, consultants and advisors.

In this report, you can find information that helps you to make informed decisions on the following issues:

- How to diversify your business and benefit from new market opportunities

- How to load your idle production capacity

- How to boost your sales on overseas markets

- How to increase your profit margins

- How to make your supply chain more sustainable

- How to reduce your production and supply chain costs

- How to outsource production to other countries

- How to prepare your business for global expansion

While doing this research, we combine the accumulated expertise of our analysts and the capabilities of artificial intelligence. The AI-based platform, developed by our data scientists, constitutes the key working tool for business analysts, empowering them to discover deep insights and ideas from the marketing data.

-

1. INTRODUCTION

Making Data-Driven Decisions to Grow Your Business

- REPORT DESCRIPTION

- RESEARCH METHODOLOGY AND AI PLATFORM

- DATA-DRIVEN DECISIONS FOR YOUR BUSINESS

- GLOSSARY AND SPECIFIC TERMS

-

2. EXECUTIVE SUMMARY

A Quick Overview of Market Performance

- KEY FINDINGS

- MARKET TRENDS This Chapter is Available Only for the Professional Edition PRO

-

3. MARKET OVERVIEW

Understanding the Current State of The Market and Its Prospects

- MARKET SIZE

- MARKET STRUCTURE

- TRADE BALANCE

- PER CAPITA CONSUMPTION

- MARKET FORECAST TO 2030

-

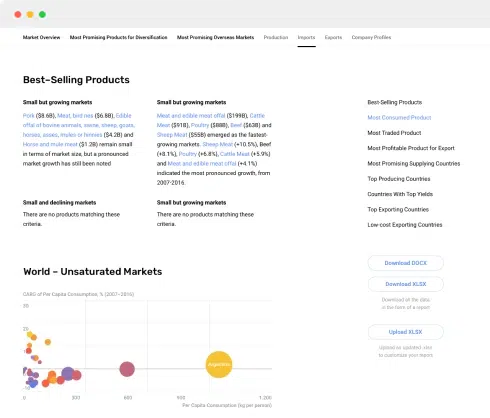

4. MOST PROMISING PRODUCT

Finding New Products to Diversify Your Business

This Chapter is Available Only for the Professional Edition PRO- TOP PRODUCTS TO DIVERSIFY YOUR BUSINESS

- BEST-SELLING PRODUCTS

- MOST CONSUMED PRODUCT

- MOST TRADED PRODUCT

- MOST PROFITABLE PRODUCT FOR EXPORT

-

5. MOST PROMISING SUPPLYING COUNTRIES

Choosing the Best Countries to Establish Your Sustainable Supply Chain

This Chapter is Available Only for the Professional Edition PRO- TOP COUNTRIES TO SOURCE YOUR PRODUCT

- TOP PRODUCING COUNTRIES

- TOP EXPORTING COUNTRIES

- LOW-COST EXPORTING COUNTRIES

-

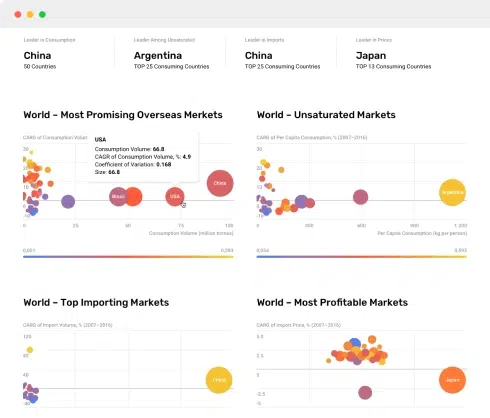

6. MOST PROMISING OVERSEAS MARKETS

Choosing the Best Countries to Boost Your Exports

This Chapter is Available Only for the Professional Edition PRO- TOP OVERSEAS MARKETS FOR EXPORTING YOUR PRODUCT

- TOP CONSUMING MARKETS

- UNSATURATED MARKETS

- TOP IMPORTING MARKETS

- MOST PROFITABLE MARKETS

7. PRODUCTION

The Latest Trends and Insights into The Industry

- PRODUCTION VOLUME AND VALUE

8. IMPORTS

The Largest Import Supplying Countries

- IMPORTS FROM 2012–2023

- IMPORTS BY COUNTRY

- IMPORT PRICES BY COUNTRY

9. EXPORTS

The Largest Destinations for Exports

- EXPORTS FROM 2012–2023

- EXPORTS BY COUNTRY

- EXPORT PRICES BY COUNTRY

-

10. PROFILES OF MAJOR PRODUCERS

The Largest Producers on The Market and Their Profiles

This Chapter is Available Only for the Professional Edition PRO -

LIST OF TABLES

- Key Findings In 2023

- Market Volume, In Physical Terms, 2012–2023

- Market Value, 2012–2023

- Per Capita Consumption In 2012-2023

- Imports, In Physical Terms, By Country, 2012–2023

- Imports, In Value Terms, By Country, 2012–2023

- Import Prices, By Country Of Origin, 2012–2023

- Exports, In Physical Terms, By Country, 2012–2023

- Exports, In Value Terms, By Country, 2012–2023

- Export Prices, By Country Of Destination, 2012–2023

-

LIST OF FIGURES

- Market Volume, In Physical Terms, 2012–2023

- Market Value, 2012–2023

- Market Structure – Domestic Supply vs. Imports, In Physical Terms, 2012-2023

- Market Structure – Domestic Supply vs. Imports, In Value Terms, 2012-2023

- Trade Balance, In Physical Terms, 2012-2023

- Trade Balance, In Value Terms, 2012-2023

- Per Capita Consumption, 2012-2023

- Market Volume Forecast to 2030

- Market Value Forecast to 2030

- Products: Market Size And Growth, By Type

- Products: Average Per Capita Consumption, By Type

- Products: Exports And Growth, By Type

- Products: Export Prices And Growth, By Type

- Production Volume And Growth

- Exports And Growth

- Export Prices And Growth

- Market Size And Growth

- Per Capita Consumption

- Imports And Growth

- Import Prices

- Production, In Physical Terms, 2012–2023

- Production, In Value Terms, 2012–2023

- Imports, In Physical Terms, 2012–2023

- Imports, In Value Terms, 2012–2023

- Imports, In Physical Terms, By Country, 2023

- Imports, In Physical Terms, By Country, 2012–2023

- Imports, In Value Terms, By Country, 2012–2023

- Import Prices, By Country Of Origin, 2012–2023

- Exports, In Physical Terms, 2012–2023

- Exports, In Value Terms, 2012–2023

- Exports, In Physical Terms, By Country, 2023

- Exports, In Physical Terms, By Country, 2012–2023

- Exports, In Value Terms, By Country, 2012–2023

- Export Prices, By Country Of Destination, 2012–2023