Australia - Unwrought Nickel - Market Analysis, Forecast, Size, Trends And Insights

Get instant access to more than 2 million reports, dashboards, and datasets on the IndexBox Platform.

View PricingAustralian Nickel Mining Companies

Australian nickel mining companies play a crucial role in the global nickel industry. Australia is one of the leading producers of nickel, known for its high-quality deposits and advanced mining technologies. This article will provide an overview of some prominent Australian nickel mining companies.

BHP Billiton

BHP Billiton, an Australian mining giant, has a significant presence in the Australian nickel industry. The company operates the Nickel West project in Western Australia, which includes various mining and processing facilities. The Nickel West project produces nickel matte, nickel briquettes, and cobalt sulfate.

Rio Tinto

Rio Tinto is another major player in the Australian nickel mining sector. The company owns and operates the Queensland Nickel project, located near Townsville in northern Queensland. The Queensland Nickel project is one of the world's largest producer of nickel and cobalt.

Western Areas

Western Areas is an independent Australian nickel mining company that focuses on high-grade nickel deposits. The company operates the Forrestania Nickel Project in Western Australia, which consists of the Flying Fox and Spotted Quoll underground mines. Western Areas also owns the Cosmos Nickel Complex, which includes the Cosmos and Odysseus mines.

Independence Group

Independence Group, commonly known as IGO, is a diversified mining company with operations in various commodities, including nickel. IGO's flagship nickel project is the Nova Operation in Western Australia. The Nova Operation is a nickel-copper-cobalt mine that commenced production in 2017. IGO also owns the Long Operation, an underground nickel mine located in Kambalda, Western Australia.

Panoramic Resources

Panoramic Resources is an Australian mining company that specializes in the exploration, development, and production of nickel, copper, and cobalt. The company operates the Savannah Nickel Project in the East Kimberley region of Western Australia. The Savannah Nickel Project is an underground mine that produces nickel concentrate.

These are just a few examples of Australian nickel mining companies, each contributing to the rich and diverse nickel industry in the country. Australia's nickel deposits, combined with the expertise and technology of these mining companies, position the country as a key global player in the nickel market.

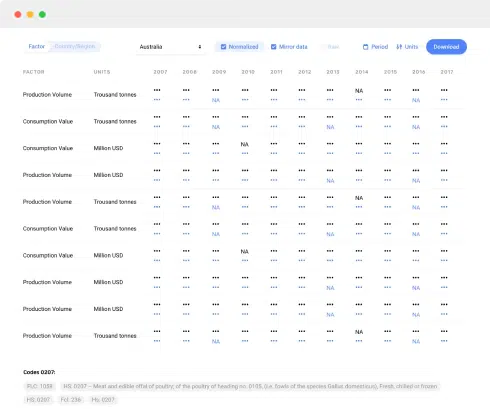

This report provides an in-depth analysis of the nickel market in Australia. Within it, you will discover the latest data on market trends and opportunities by country, consumption, production and price developments, as well as the global trade (imports and exports). The forecast exhibits the market prospects through 2030.

Product coverage:

- Prodcom 24451100 - Nickel, unwrought

- Prodcom 24451110 -

- Prodcom 24451120 -

Country coverage:

- Australia

Data coverage:

- Market volume and value

- Per Capita consumption

- Forecast of the market dynamics in the medium term

- Trade (exports and imports) in Australia

- Export and import prices

- Market trends, drivers and restraints

- Key market players and their profiles

Reasons to buy this report:

- Take advantage of the latest data

- Find deeper insights into current market developments

- Discover vital success factors affecting the market

This report is designed for manufacturers, distributors, importers, and wholesalers, as well as for investors, consultants and advisors.

In this report, you can find information that helps you to make informed decisions on the following issues:

- How to diversify your business and benefit from new market opportunities

- How to load your idle production capacity

- How to boost your sales on overseas markets

- How to increase your profit margins

- How to make your supply chain more sustainable

- How to reduce your production and supply chain costs

- How to outsource production to other countries

- How to prepare your business for global expansion

While doing this research, we combine the accumulated expertise of our analysts and the capabilities of artificial intelligence. The AI-based platform, developed by our data scientists, constitutes the key working tool for business analysts, empowering them to discover deep insights and ideas from the marketing data.

-

1. INTRODUCTION

Making Data-Driven Decisions to Grow Your Business

- REPORT DESCRIPTION

- RESEARCH METHODOLOGY AND AI PLATFORM

- DATA-DRIVEN DECISIONS FOR YOUR BUSINESS

- GLOSSARY AND SPECIFIC TERMS

-

2. EXECUTIVE SUMMARY

A Quick Overview of Market Performance

- KEY FINDINGS

- MARKET TRENDS This Chapter is Available Only for the Professional Edition PRO

-

3. MARKET OVERVIEW

Understanding the Current State of The Market and Its Prospects

- MARKET SIZE

- MARKET STRUCTURE

- TRADE BALANCE

- PER CAPITA CONSUMPTION

- MARKET FORECAST TO 2030

-

4. MOST PROMISING PRODUCT

Finding New Products to Diversify Your Business

This Chapter is Available Only for the Professional Edition PRO- TOP PRODUCTS TO DIVERSIFY YOUR BUSINESS

- BEST-SELLING PRODUCTS

- MOST CONSUMED PRODUCT

- MOST TRADED PRODUCT

- MOST PROFITABLE PRODUCT FOR EXPORT

-

5. MOST PROMISING SUPPLYING COUNTRIES

Choosing the Best Countries to Establish Your Sustainable Supply Chain

This Chapter is Available Only for the Professional Edition PRO- TOP COUNTRIES TO SOURCE YOUR PRODUCT

- TOP PRODUCING COUNTRIES

- TOP EXPORTING COUNTRIES

- LOW-COST EXPORTING COUNTRIES

-

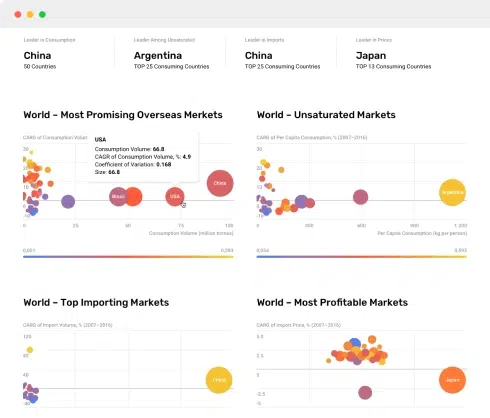

6. MOST PROMISING OVERSEAS MARKETS

Choosing the Best Countries to Boost Your Exports

This Chapter is Available Only for the Professional Edition PRO- TOP OVERSEAS MARKETS FOR EXPORTING YOUR PRODUCT

- TOP CONSUMING MARKETS

- UNSATURATED MARKETS

- TOP IMPORTING MARKETS

- MOST PROFITABLE MARKETS

7. PRODUCTION

The Latest Trends and Insights into The Industry

- PRODUCTION VOLUME AND VALUE

8. IMPORTS

The Largest Import Supplying Countries

- IMPORTS FROM 2012–2023

- IMPORTS BY COUNTRY

- IMPORT PRICES BY COUNTRY

9. EXPORTS

The Largest Destinations for Exports

- EXPORTS FROM 2012–2023

- EXPORTS BY COUNTRY

- EXPORT PRICES BY COUNTRY

-

10. PROFILES OF MAJOR PRODUCERS

The Largest Producers on The Market and Their Profiles

This Chapter is Available Only for the Professional Edition PRO -

LIST OF TABLES

- Key Findings In 2023

- Market Volume, In Physical Terms, 2012–2023

- Market Value, 2012–2023

- Per Capita Consumption In 2012-2023

- Imports, In Physical Terms, By Country, 2012–2023

- Imports, In Value Terms, By Country, 2012–2023

- Import Prices, By Country Of Origin, 2012–2023

- Exports, In Physical Terms, By Country, 2012–2023

- Exports, In Value Terms, By Country, 2012–2023

- Export Prices, By Country Of Destination, 2012–2023

-

LIST OF FIGURES

- Market Volume, In Physical Terms, 2012–2023

- Market Value, 2012–2023

- Market Structure – Domestic Supply vs. Imports, In Physical Terms, 2012-2023

- Market Structure – Domestic Supply vs. Imports, In Value Terms, 2012-2023

- Trade Balance, In Physical Terms, 2012-2023

- Trade Balance, In Value Terms, 2012-2023

- Per Capita Consumption, 2012-2023

- Market Volume Forecast to 2030

- Market Value Forecast to 2030

- Products: Market Size And Growth, By Type

- Products: Average Per Capita Consumption, By Type

- Products: Exports And Growth, By Type

- Products: Export Prices And Growth, By Type

- Production Volume And Growth

- Exports And Growth

- Export Prices And Growth

- Market Size And Growth

- Per Capita Consumption

- Imports And Growth

- Import Prices

- Production, In Physical Terms, 2012–2023

- Production, In Value Terms, 2012–2023

- Imports, In Physical Terms, 2012–2023

- Imports, In Value Terms, 2012–2023

- Imports, In Physical Terms, By Country, 2023

- Imports, In Physical Terms, By Country, 2012–2023

- Imports, In Value Terms, By Country, 2012–2023

- Import Prices, By Country Of Origin, 2012–2023

- Exports, In Physical Terms, 2012–2023

- Exports, In Value Terms, 2012–2023

- Exports, In Physical Terms, By Country, 2023

- Exports, In Physical Terms, By Country, 2012–2023

- Exports, In Value Terms, By Country, 2012–2023

- Export Prices, By Country Of Destination, 2012–2023

This report provides an in-depth analysis of the nickel market in Australia.

This report provides an in-depth analysis of the global nickel market.

This report provides an in-depth analysis of the nickel market in Australia.

This report provides an in-depth analysis of the nickel market in Australia.

This report provides an in-depth analysis of the global nickel market.

This report provides an in-depth analysis of the global nickel market.

Discover the top import markets for nickel in the world based on 2023 data. Explore the countries driving demand for nickel across various industries.

Global nickel imports totaled X tons in 2016, import ,therefore, remained relatively stable against the previous year level. The total import volume increased at an average annual rate of +X% fro...

Global nickel imports totaled X tons in 2016, import ,therefore, remained relatively stable against the previous year level. The total import volume increased at an average annual rate of +X% fro...

Canada continued to dominate in the global unwrought nickel trade. In 2014, Canada exported X thousand tons of unwrought nickel totaling X million USD, X% under the previous year. Its primary trading partner was the U.S., where it supplied X%

The Russian Federation dominates in the global unwrought nickel trade. In 2014, Russian Federation exported more than X thousand tons of unwrought nickel totaling X billion USD, X% over the previous year. Its primary trading partner was China, wh

Nickel prices skyrocketed on the expectations of a shortage on the global market provoked by the increase in demand that outpaces the supply growth. The rebound in the steel industry and rising electric vehicle manufacturing drive nickel consumption. Pandemic-related lockdowns in the first half of 2020 and the related uncertainty led to a decrease in the global nickel mine output by -4% y-o-y. Despite this, refined nickel production increased by +2% y-o-y, boosted by the recovering demand from mid-2020 and the use of secondary smelting. Indonesia, the largest nickel ore producer worldwide, banned exports of the ore and thus achieved a record output of refined nickel.

Discover the top import markets for nickel in the world based on 2023 data. Explore the countries driving demand for nickel across various industries.

Global nickel imports totaled X tons in 2016, import ,therefore, remained relatively stable against the previous year level. The total import volume increased at an average annual rate of +X% fro...

Global nickel imports totaled X tons in 2016, import ,therefore, remained relatively stable against the previous year level. The total import volume increased at an average annual rate of +X% fro...

Canada continued to dominate in the global unwrought nickel trade. In 2014, Canada exported X thousand tons of unwrought nickel totaling X million USD, X% under the previous year. Its primary trading partner was the U.S., where it supplied X%